New guideline focuses on pilot FTZs

The recent guideline on the reform of China's pilot free-trade zones will effectively facilitate foreign investment in China, particularly in the services sector, and demonstrates China's resolution for greater opening-up efforts, experts and industrial insiders said.

On Sept 3, the State Council, China's Cabinet, unveiled a guideline with innovative reform measures to facilitate investment in the country's pilot FTZs. The new measures include unleashing the potential for offshore trade in these zones, fostering innovation in investment trade and increasing the diversity of commodity futures.

Wang Shouwen, vice-minister of commerce, noted in a news briefing after the guideline's release that the State Council has been rolling out policy incentives in support of pilot FTZ growth every year since 2018. This time, the 19 new incentives focus on advancing investment and trade facilitation.

"By introducing these measures, the government aims to deepen the integrated innovation of trade and investment facilitation of FTZs and give them greater command over reform, formulating more experiences that can be replicated nationwide," Wang said at the briefing.

"The new guideline has promoted many reform measures in areas of trade, investment, international logistics and the financial sector serving the real economy," he added. "We expect these measures will work effectively to better energize market vitality and foster new advantages for development."

As part of the latest measures, the process of importing medical products, including medicine, will be further liberalized. Where conditions permit, the FTZs will be encouraged to carry out imports of certain drugs and medical devices via cross-border e-commerce.

Among the new document's highlights, innovation for import trade will be further incentivized, and import demonstration zones in the FTZs will be supported. More efforts will also be made to seek innovation in regulatory mechanisms for imports, business models and supporting services.

Zhou Mi, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation in Beijing, said that with China becoming the world's largest recipient of foreign direct investment last year, the country is aiming for high quality, more diverse import trade, thus offering more facilitated, innovative regulatory approaches.

Zhang Yong, a senior researcher at the Research Institute of Free Trade Zone at Fudan University in Shanghai, noted that the new guideline has a particular focus on offshore trade.

"With China deepening its distribution and layout of the global industrial chain, supply chain and value chain, an increasing number of local enterprises are benefiting from opening-up experiences accumulated from the pilot zones, particularly for overseas direct investment. Now, they are also looking for the best allocation of resources with lower costs from wider areas, which generates faster growth of import trade," he said.

Vice-Minister Wang noted that in recent years, targeted policy support has been rolled out to explore the potential of pilot FTZ growth.

To illustrate, the first national negative list for foreign investment was issued in pilot FTZs to foster greater opening-up. These zones have taken the lead in applying the negative list mechanism for foreign investment.

In this document, the new measures will also facilitate the financial services sector to serve the real economy. The varieties of commodity futures will be increased, and efforts will be expedited to bring in overseas traders and improve the regulatory framework for bonded delivery.

In addition, a pilot all-in-one domestic and foreign currency bank settlement account system will be initiated.

Cline Zhang, Shanghai Branch Manager of Citi China, noted that such an account system is a critical, innovative step in enabling the business climate and energizing the development of market players in the FTZs.

"Under the new guideline, the number of bank accounts in need of corporate treasury management will be notably reduced. This will bring down corporate management costs, enabling channels for more resources to serve businesses," she said.

Efforts put forth by the guideline will also reduce the number of bank accounts that businesses need to manage, she said, and this will facilitate their operations on the financial front.

The new document also contains more measures related to international flights and logistics. International airports in cities where pilot FTZs are located will be encouraged to exercise Fifth right-the right of an airline to fly a route connecting two or more countries in addition to the country of origin.

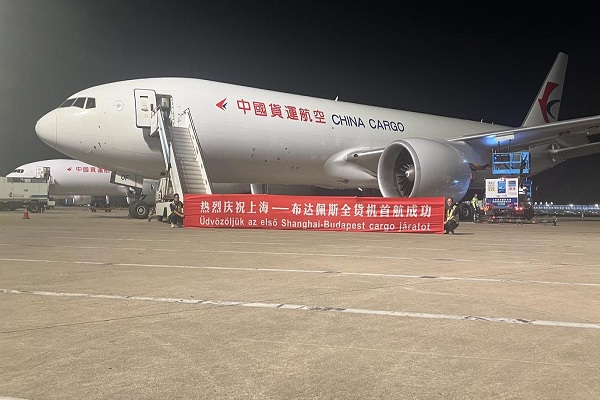

Though the COVID-19 pandemic has severely disrupted global trade, some pilot FTZs have been working to enhance air cargo links to ensure unimpeded air transportation for medical and high-value added goods since last year.

According to Shen Xiaoshu, deputy head of the Shenyang area of China (Liaoning) Pilot Free Trade Zone, the air cargo route between Shenyang, capital of Liaoning province, and Seoul, capital of South Korea, is expected to operate up to 100 flights by the end of this year.

The zone provides a channel for producers in both Shenyang and other cities across Liaoning to export their products in a timely manner, Shen said.